The Future of Real Estate

FORE is a commercial real estate networking group focused on developing young industry leaders by hosting interactive events.

Our Mission

FORE’s mandate is to encourage young commercial real estate professionals and its stakeholders to (1) expand their knowledge of industry trends and processes through mentorship from established market participants and (2) connect with their peers as they navigate the first half of a long and successful career. The group values the importance of building an extensive contact base and welcomes all individuals with attachments to the real estate community, including , law, third party reporting, investors, and service providers.

Meet The Team

Kelvin is a Manager of Investments & Asset Management at Montcrest Asset Management and provides analytical/financial support for all acquisition, development, and asset management activities. Kelvin was formerly with the development team at First Capital REIT where he was responsible the analytical support for over $500M in mix-use developments. Prior to joining First Capital REIT, Kelvin was an analyst for Avison Young where he was responsible for providing underwriting, market research, and preparing Confidential Information Memorandums (CIMs). Kelvin holds a Bachelor of Commerce with high distinction from the University of Toronto and is currently a Board Member of Woodgreen Community Services.

Catherine Price is an associate on the Real Estate Investment team at Fengate Asset Management where she provides underwriting, financial/analytical and due diligence support for the team. She was previously a financial analyst at Avison Young in the Capital Markets Group for four years, where she was involved in over $1 billion of sales. Prior to Avison Young, she worked at PriceWaterhouse Coopers in the assurance department. Catherine holds a Bachelor of Commerce, Major in Finance, with distinction from Dalhousie University.

Clarissa Chan is a Real Estate Specialist at the Region of Durham. She negotiates real estate agreements, conducts internal appraisal/valuation reports, provides recommendations of Regionally owned land/buildings, site selection reviews, surplus declaration, expertise on expropriation and acquisitions (full takings, partial takings, easements). She has experience in both the private and public sectors. Clarissa holds an associate membership with the Institute of Municipal Assessors and is an accredited commercial appraiser with the Appraisal Institute of Canada.

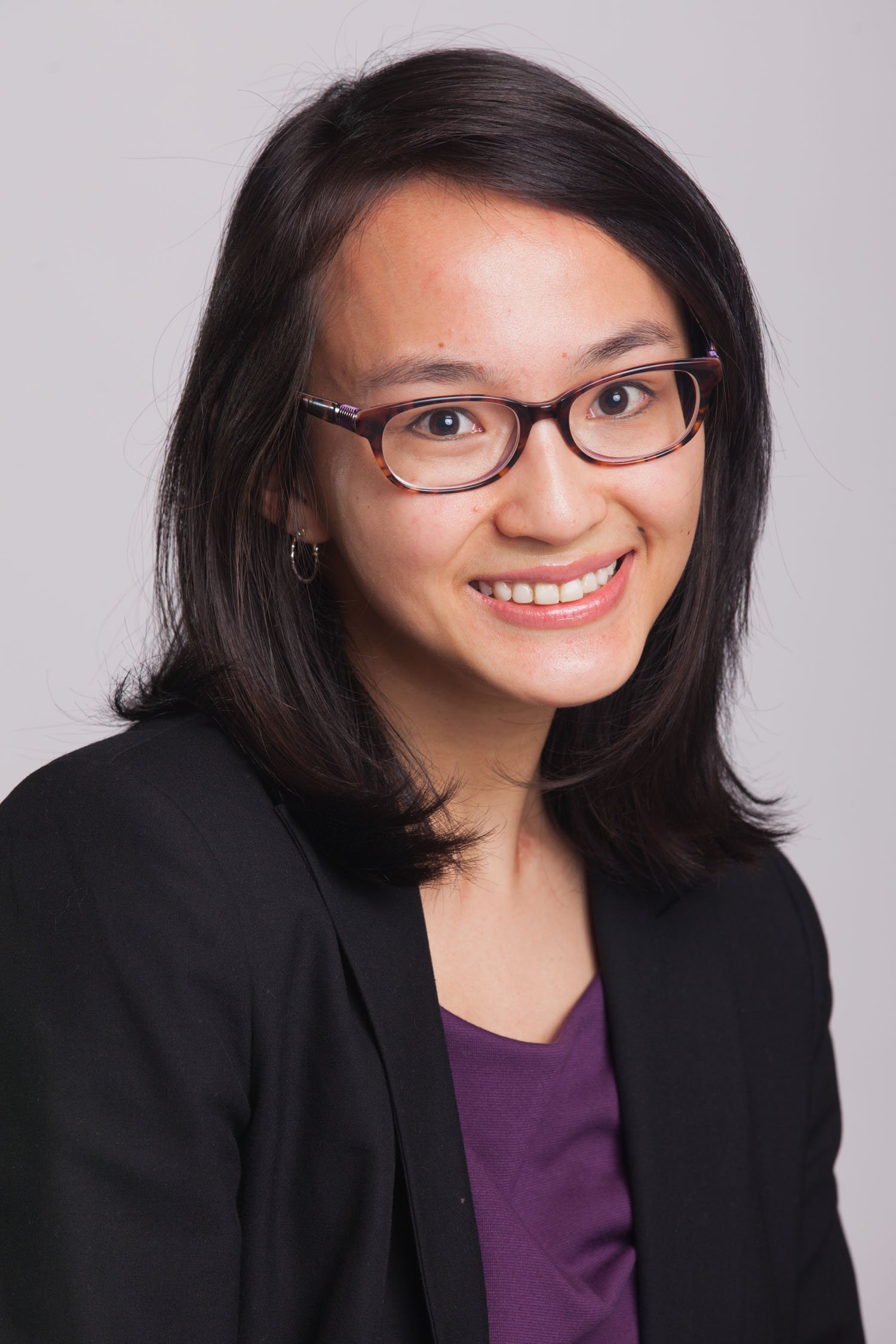

Jing is an Associate on the acquisition team at LaSalle Investment Management, where she is responsible for real estate investment underwriting and transactions with a focus on office, retail, multi-family, industrial, and development. Prior to that, Jing worked at Cushman & Wakefield and JLL, both are real estate advisory firms where she was responsible for a wide range of valuation and consulting assignments with a focus on hospitality, office, industrial and retail properties.

Jing holds a Bachelor of Commerce degree from Toronto Metropolitan University and the Accredited Appraiser Canadian Institute (AACI) designation.

Daiana is an Analyst on the Underwriting team at Atrium Mortgage Investment Corporation, where she supports the origination, evaluation and management of commercial mortgage investment opportunities. Prior to joining Atrium MIC, Daiana has recently graduated from McGill University with a major in Economics and Finance.

Max Harada holds the position of Manager, Real Estate Investments at PSP Investments, covering the acquisition process as well as asset and partner management. Prior to joining PSP Investments, Max was a Manager at QuadReal Property Group with a focus on Investments & Development and a Senior Analyst with a focus on opportunistic lending strategies at CMLS Financial. Max holds an Honours Bachelor of Economics and Financial Management degree from Sir Wilfrid Laurier University and is a CFA® charterholder.

KD Dao is Co-founder & COO of Ryna, a next generation rental provider for modern women & inclusive minded allies. Prior to founding Ryna, she held the Associate position at LaSalle Investment Management’s Asset Management and Acquisition teams. Prior to joining LaSalle Investment Management, Karen has previous experience as an analyst for Shell Canada, and holds a Bachelor of Commerce from Queen’s University.